Zirtue

Virtue is a unique financial services company that provides an alternative to traditional payday loan companies. It offers both short-term loans and long-term credit lines with competitive rates and flexible repayment options. Zirtue was created to provide people in need of emergency funds access to quick, affordable financing without the hassle or worry of high-cost payday loans. Unlike Advance America, Zirtue eliminates the need for multiple trips to the store and long waiting periods when applying for a loan.

Zirtue offers customers an easy online application process with immediate approval decisions in minutes. They have no hidden fees, no collateral needed, and don’t require any additional paperwork when signing up for their services. Customers can also enjoy convenient payment methods via ACH/wire transfer or by having their monthly payments automatically deducted from their bank account on specified dates.

Zirtue Features

1: Simplified Transactions

2: Secure Platform

3: Low Fees

4: Flexible Payment Options

5: Robust Customer Support

Zirtue Alternatives

Advance America

As the demand for short-term financial solutions continues to rise, more alternative loan companies have emerged. Advance America is a popular option for those seeking immediate funds, but several other alternatives have similar features and benefits. This article will explore some of the top Advance America alternatives and their key features to help you decide which is best suited for your needs.

Advance America Features

- Accessibility: 24/7 Support

- Technology: Innovative Tools

- Security: High Standards

- Cost: Affordable Profile

- Quality Service

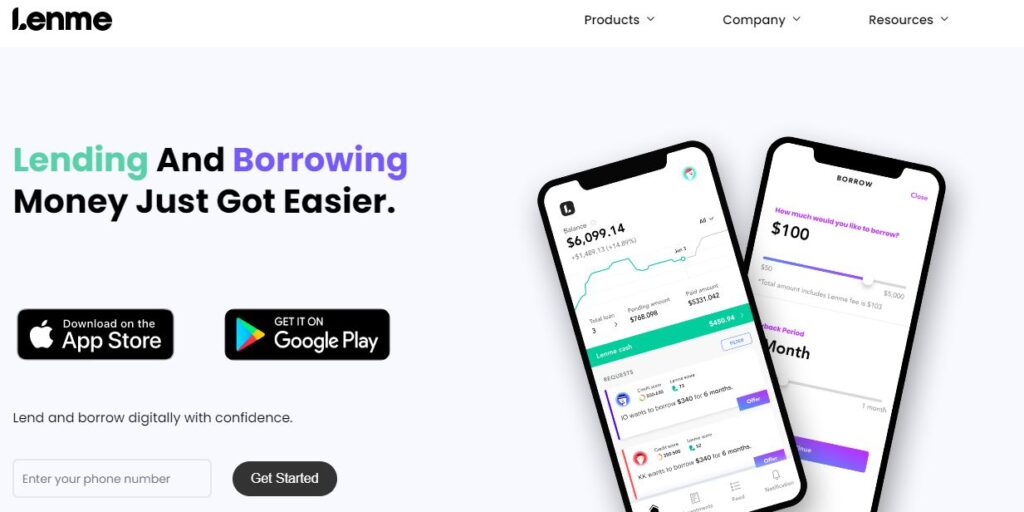

Lenme

Lenme is the latest addition to the financial services market, and it has some features that make it stand out from other providers. This platform offers a unique take on short-term loans, allowing users to borrow money quickly with lower fees than traditional lenders. Lenme also allows customers to pay back their loans in installments, giving them more flexibility and control over their finances.

It’s an ideal solution for those who need cash fast but don’t want to be burdened by high-interest rates or long repayment terms.

Lenme provides borrowers with various options regarding loan amounts, repayment periods, and interest rates. Borrowers can choose from loan amounts ranging from $100-$5,000 and repayment terms of up to 12 months, depending on their credit score.

MaxSol

MaxSol is a modern lender that provides quick and reliable short-term loans. From payday loans to installment loans, MaxSol aims to provide customers with the financial services they need when they need them. Their online services make it easy for customers to apply for a loan and receive funds as quickly as the same business day.

The company’s application process is simple, taking only minutes to complete. Once approved, a customer can receive their funds through direct deposit or loading them onto a prepaid debit card. Customers have access to the MaxSol website 24 hours per day and seven days per week, so they can easily manage their accounts from anywhere at any time. In addition, MaxSol’s friendly customer service line is available for those needing assistance with any part of the process.

Core Features:

- High-Speed Processing

- Security & Privacy

- Ease of Use

- Automated Updating

- Customizable Options

Loans Unlimited – Cash Advance

Cash Advance is the ideal solution for those in need of quick cash. The company offers a wide variety of loan products and services that are designed to meet the financial needs of almost anyone. With its easy application process, competitive interest rates, and fast approval decisions, Loans Unlimited makes it easier to access the money you need when you need it most.

Loans Unlimited provides short-term loans such as payday and cash advances. Their convenient online application process means that customers can apply for a loan from the comfort of their home or office at any time of day or night. Approval decisions are made quickly, so customers can immediately get their much-needed funds. Customers can also benefit from flexible repayment options with Loans Unlimited, allowing them to repay their loans over several months instead of all at once if desired.

Loans Unlimited features

- Benefits: Instant Access, Easy to Use

- Security: SSL Encrypted, Data Protection

- User Interface: Simple to Navigate

- Fees: Affordable and Transparent

- Repayment Terms: Flexible and Customizable

- Promotion: Referral Rewards Program

Possible: Fast Cash & Credit

Do you need cash fast? Are you looking for an alternative to Advance America? Consider these possible options, Fast Cash & Credit. Fast Cash & Credit is great if you want quick access to your funds and easy repayment plans.

Fast Cash & Credit offers loans at reasonable interest rates less than traditional payday lenders, making them a more affordable choice. With Fast Cash & Credit, you can apply online in just minutes, and they’ll get back to you with approval within 48 hours.

The loan amount will be transferred directly into your account, so it’s convenient and easy.

Fast Cash & Credit also offers flexible payment plans tailored to suit your needs; there’s no need to worry about late fees or penalties if you miss a payment date, as the company will work with you to find a suitable plan.

Fast Cash & Credit features

- Setup: Signing up & Security

- Payments: Send & Receive Money

- Credit Reports: Monitor & Improve

- Budgeting: Track Spending & Save

- Rewards: Earn Cashback & More

- Get Financial Control

Loans – All In One

One of the most common sources of quick financial assistance is a loan. Various loan options are available, but Advance America is one of the most popular. Several possibilities could fit the bill for those who need to find alternatives to Advance America for their loan needs. Let’s look at some of the different features and benefits these alternative lenders offer.

Cash Advance – TSAIP Loan

Cash Advance TSAIP Loan App is a new and exciting way for those needing financial assistance to get fast cash. The app offers an alternative to traditional payday loans, making it easier and quicker for individuals to borrow money without having to go through the hassle of waiting for a bank loan or dealing with the paperwork associated with applying for one.

The Cash Advance TSAIP Loan App provides borrowers with access to funds within minutes of submitting their application, eliminating long wait times typically seen when applying for a loan from a bank. It also has flexible repayment terms that allow users to choose how much they can afford to pay each month and options such as interest-only payments, which may be beneficial depending on your financial circumstances.

In addition, the Cash Advance TSAIP Loan App allows you to easily manage your loan via their user-friendly mobile app and website. “I had a very positive experience with Cash Advance USA. I received a loan relatively quickly, which was a very smooth process. They were beneficial in answering my questions and helping me understand what I needed to do to get the loan.