SoLo Funds: Lend and Borrow

Hundy, an online peer-to-peer lending platform, has revolutionized how people borrow and lend money. But what if you want to explore other options? SoLo Funds is a leading alternative that allows borrowers to secure quick loans from lenders without paying high-interest rates or fees.

SoLo Funds provides a safe and easy way for individuals to borrow and lend money with minimal risk. Unlike traditional banks and lenders, borrowers can access lower interest rates – as low as 5% – with no hidden fees or penalties.

The platform also eliminates the need for complex paperwork by allowing borrowers to secure funds within minutes of application approval. As a bonus, SoLo Funds also offers 24/7 customer support, so users are always aware of their loan agreement or repayment schedule.

SoLo Funds Platform features

1: Instant Access

2: Ease of Use

3: Investment Tracking

4: Low Fees

5: Security

SoLo Funds Alternatives

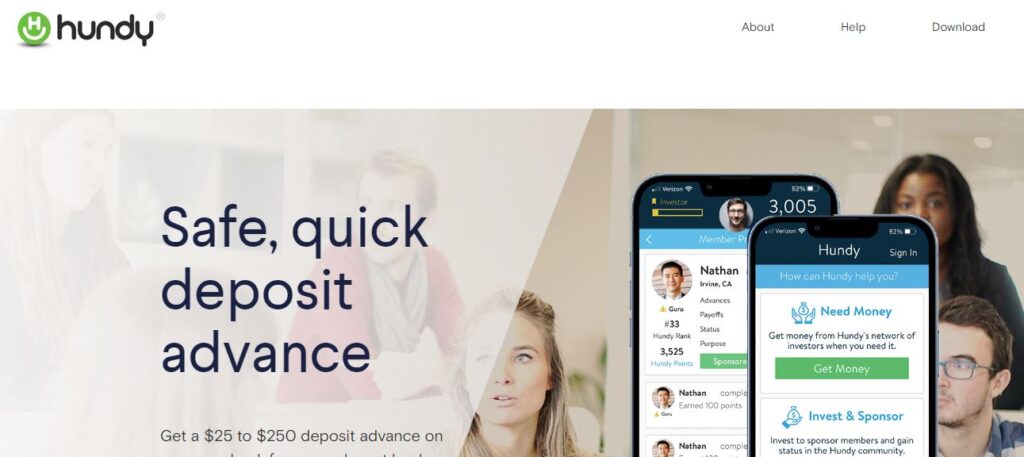

Hundy

The rise of technology has made it easier to access and manage money, offering alternatives to traditional banking systems. Whether you need a loan, an emergency fund, or want more control over your finances, there are now various options. Hundy is one such option that provides users with quick, easy access to their money when they need it most.

Hundy Platform features

- Automated Investing

- Tax Optimization

- Portfolio Rebalancing

- Community Support

- Socially Responsible in Investing

- Lead Better Financial Lives

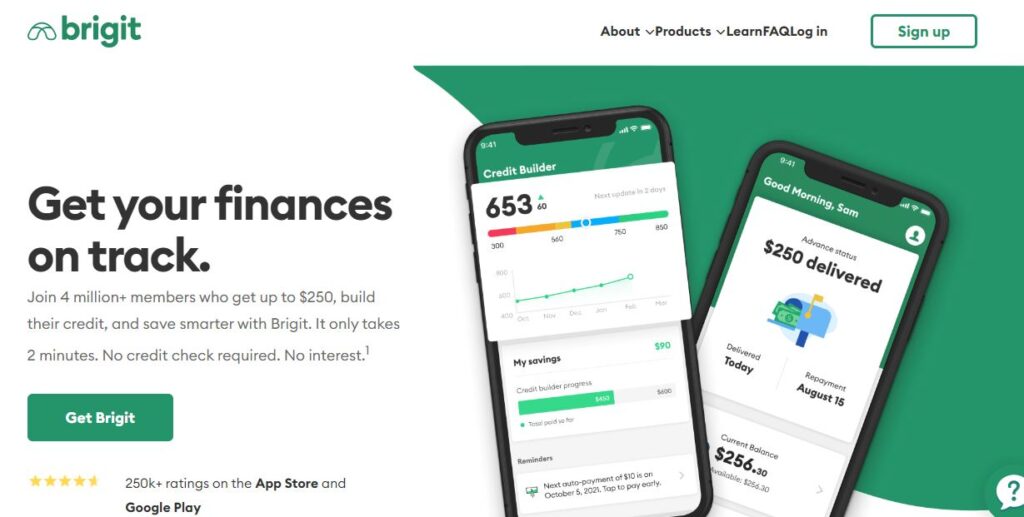

Brigit: Get a $250 Cash Advance

Brigit is an app-based service that helps users get up to a $250 cash advance when needed. It’s an alternative to Hundy, another popular money service. Brigit makes the process of getting a cash advance fast and easy: users connect their bank account to the app and can request their advance whenever they need it. The process only takes minutes, so you will immediately get approval and funds.

Unlike other services like Hundy, Brigit doesn’t require fees or interest payments; instead, each user pays an affordable monthly subscription fee in exchange for access to up to three monthly advances. That means there are no surprise charges for using Brigit: you’ll always know exactly how much your cash advances will cost before you apply.

Brigit Features

- Financial Support Features

- Budgeting & Savings Features

- Credit Building Features

- Community Support Features

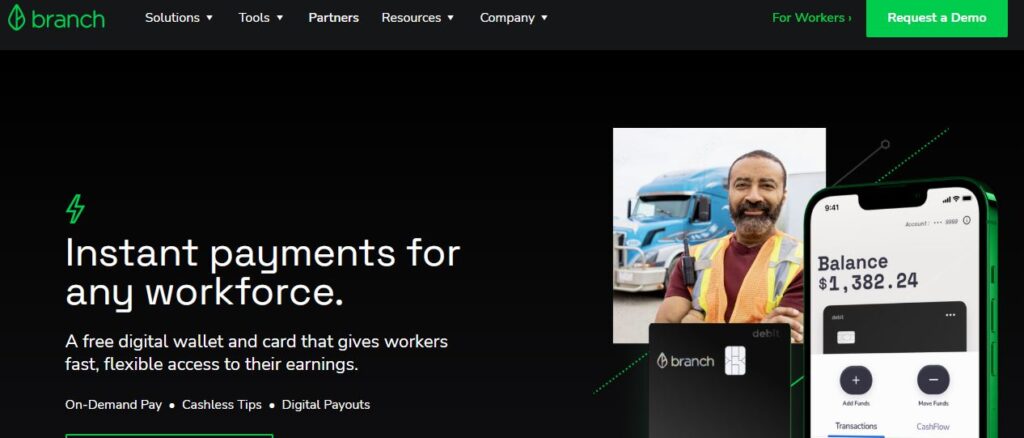

Branch: No Wait Pay

As the gig economy grows, new financial services and products are becoming available to help people manage their cash flow. One of these innovative companies is called Branch: No Wait Pay. Branch offers a way for gig workers to get their paychecks immediately following the completion of each job. This service allows them to access their earnings faster than ever before and helps bridge financial gaps between jobs or projects.

Branch provides an easy-to-use mobile app that securely links users’ existing bank accounts with their employers. Once connected, employers can digitally transfer payments directly into employees’ accounts and receive notifications when funds become available. The service cuts out expensive paper checks or inconvenient trips to the bank, allowing users to get paid as soon as possible after completing a task or assignment.

User Experience Features

- Data Analysis Tools

- Customization Options

- Security and Privacy

- Integrations and APIs

- Pricing Plans

Empower: Instant Cash Advance. Get up to $250

Introducing the Empower Instant Cash Advance, a new financial service that gives you access to cash when you need it most. With Empower, you can get up to $250 in just minutes with no credit check. It is a great alternative for those looking for quick cash without going through a lengthy process or worrying about their credit score.

Empower makes it easy and convenient to get fast cash. All you have to do is apply online, provide your bank account information, and wait for approval from Empower’s team of experts within minutes. Once approved, your money will be deposited directly into your account the same day or the next business day. Plus, there are no hidden fees associated with this service — only a flat fee of $5 per transaction — so you know exactly what you’re paying for every time.

Empower Features

- User-Friendly Interface

- Automated Tools

- Security

- Mobile Accessibility

- Integrations

Vola Finance

Vola Finance is a financial services company that has recently gained popularity as it offers an innovative alternative to traditional banking. Vola Finance creates an ecosystem of products and services that empower individuals, businesses, and organizations to build financial freedom through its mobile technology solutions. The company was founded by a group of experienced entrepreneurs from the fintech industry passionate about revolutionizing how people save, invest, and manage their money.

Vola Finance provides customers access to low-cost investment funds, allowing users to diversify their portfolios without paying high fees or commissions. Vola’s suite of mobile tools also provides users with real-time insights into their finances and personalized advice on achieving their financial goals. Customers can quickly start investing with confidence through its intuitive user interface and simple setup process.

Vola Finance Features

1: Decentralized Governance

2: Efficient Liquidity Solutions

3: Multi-Chain Support

4: Fair Token Distribution

5: Community-Driven Development