The abbreviation ETF stands for Exchange traded fund, or “a fund traded on the stock exchange.” ETF is a public investment fund that lists for sale on the stock exchange universal stocks, consisting of stocks of different companies. Such securities can be managed in exactly the same way as standard exchange assets, and their value depends on the market balance of supply and demand at a particular point in time.

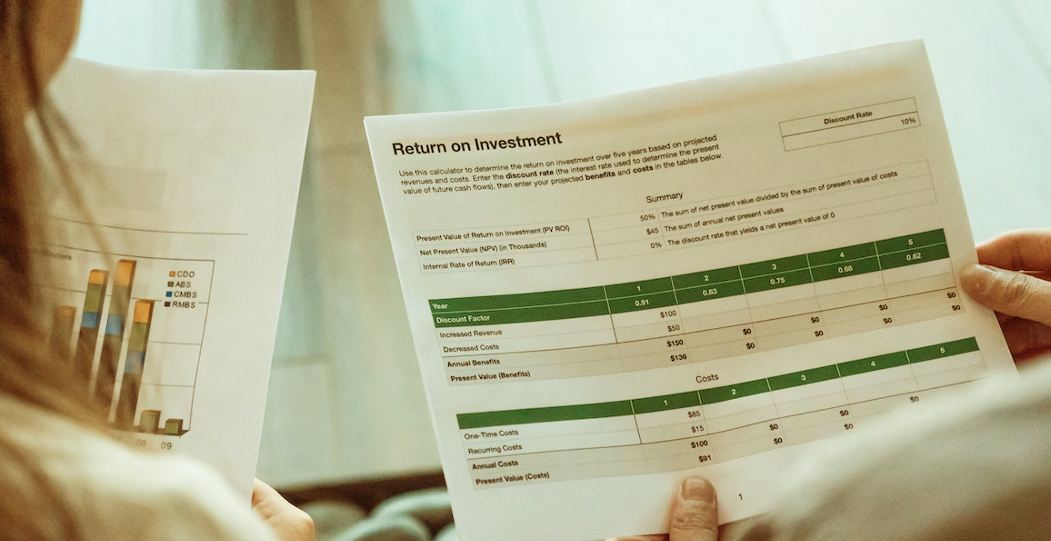

An investment portfolio usually includes:

- company stocks;

- state, municipal, corporate bonds;

- options, futures;

- currency;

- precious metals;

- other assets.

Investment instruments differ in their level of risk and return. For example, investments in startup stocks are considered the most risky, while investments in bonds are considered the lowest.

The investor can choose which securities to include in his portfolio, or entrust this to experts. The broker DotBig has ready-made solutions for both beginners and experienced investors.

It should be noted that different types of investment portfolios are distinguished, namely:

1. According to the degree of risk. An investment portfolio, depending on the degree of risk, can be low-risk, moderate or high-risk.

2. According to the degree of investor involvement. An active portfolio requires constant monitoring of quotes and management on a 24/7 basis. As a rule, the set includes risky assets: high-yield and high-risk stocks and bonds, start-ups, and initial public offerings. A passive portfolio does not require high investor involvement, ongoing analytics and monitoring. As part of the passive portfolio, most often stocks of index funds, mutual funds, precious metals. The investor’s involvement is reduced to a minimum if he chooses an investment program with trust management: the bank’s experts independently create a harmonious investment portfolio for the owner of a brokerage account and make transactions on the stock exchange.

3. According to the timing of the goal. In such a case, the investment portfolio can be:

- short-term – up to 3 years;

- medium-term from 3 to 10 years;

- and long-term – over 10 years.

What makes Portfolio Investment so special in the world of trading?

Investment portfolios are attractive in that they are based on the optimal combination of various assets. Reliable financial instruments are used for capital protection. The portfolio yield is provided by efficient but risky assets. To achieve a sustainable result, it is important to maintain a balance between the two.

Why do investors choose Portfolio Investments?

Investors choose portfolio investments for a variety of reasons. Firstly, this is due to the fact that the investor has several options to appoint his representative to the board of directors of the company in which he intends to invest. The most popular is to buy out a stock of an enterprise, to receive its stocks in exchange for money or other property. In any case, direct investment is an individual and unpredictable process: who would have thought that Apple and Microsoft would one day grow out of a pair of garage companies. But this was done, among other things, by attracting direct investors who believed in the idea of the founders of these IT giants.

In this case, the investor is interested in receiving passive income from investments distributed among several assets: stocks, bonds, promissory notes and other financial instruments. This is the so-called portfolio, which is managed by the depositor or stock broker. The composition of the portfolio is chosen arbitrarily, taking into account the expected risks and level of return. With this approach, the investor is protected and receives a predictable profit: while some assets are falling in price, others continue to grow.

Potential pros and cons of portfolio investment

Portfolio investment has several significant advantages:

- the possibility of obtaining passive income;

- relatively low entry threshold;

- the opportunity for the investor to independently regulate the level of risks and profitability, based on their own goals and preferences.

With a large set of advantages, portfolio investment also has disadvantages:

- risk of loss of invested funds, which can be reduced using a conservative portfolio formation technique;

- the presence of certain knowledge in the field of the stock market, investment, and finance.

Despite the high risks, you can invest wisely by choosing the best broker that provides up-to-date asset information.

Conclusion

If you are interested in contributing to portfolio investments, you should understand that any investment is associated with 2 types of risks:

Unsystematic risk or security risk. The reason may be the bankruptcy of the issuing company. In this case, the losses to the investor, most likely, will not be reimbursed. The stock price will fall to zero, after which the securities will be withdrawn from circulation.In the fight against non-systematic risks, it is recommended to adhere to the following rules:

- to purchase securities of reliable companies with expected growth in the long term, the probability of default on which is minimal;

- diversify portfolio by acquiring assets of several issuers.

It is possible to reduce systemic risks by acquiring assets that are resistant to market fluctuations. In general, in order to successfully invest, you can follow the latest information from your broker for changes in quotes.

F.A.Q.

Why should you pay attention to portfolio investment?

It is very difficult to predict the profitability of an asset. In the sea of investments, the weather is constantly changing – either an inflationary storm will drop the profitability of bank deposits to negative values, or a calm on the cryptocurrency exchange will freeze deposits

To protect your investments, it is best to diversify them by investing in various assets at the same time. A set of securities of different types, liquidity, and duration is called an investment portfolio.

How much to invest?

The initial investment amount will be individual in each case. If this is the opening of a deposit, then $100 will be enough. But for investing in real estate – it’s tens of thousands of dollars. It is worth remembering that the more money you are willing to invest, the more financial instruments are available to you.

Also, at the initial stage, you need to accustom yourself to the fact that, having started investing, you need to be ready to comply with the regularity of investments. It can be provided with dividends or a part of business income, money from renting an apartment or just 10% of each salary.

Who can invest in portfolio investments?

Investors are individuals, investment funds, banks, and other financial institutions.