GoCardless

GoCardless is a payment service provider that enables businesses to collect payments from customers directly from their bank accounts. It offers a secure, reliable, and efficient way to process payments, eliminating the hassle of manual processes such as cheques and cash. The service also simplifies the reconciliation process, reducing costs associated with administrative tasks. With GoCardless, businesses can easily set up recurring customer payments by entering their bank account details. It helps companies collect regular payments for subscription services or invoices without contacting customers manually.

Additionally, GoCardless allows businesses to manage their payments through an intuitive dashboard where they can view customer information and transaction history. Furthermore, it integrates with popular accounting software such as Xero and Quickbooks for automated bookkeeping processes. GoCardless is a great alternative for Sezzle users looking for an easy-to-use platform with fast payment processing times and comprehensive financial analytics tools.

Core Features:

- Automated Payments

- Multi-Currency

- Bank Transfers

- Advanced Features:

- Smart Routing

- Direct Debits

- Security and Compliance:

- PCI DSS Certified

- Fraud Protection

- Integration Options:

- API Accessibility

GoCardless Alternatives

Sezzle

Shopping online can be easier with a credit card or access to funds. Thankfully, several payment options are now available, making it easier for shoppers to purchase the items they need without worrying about their finances. One of these services is Sezzle, which enables consumers to pay for their purchases in four installments with no interest or fees. However, plenty of Sezzle alternatives have similar features if you’re looking for other options.

Sezzle features

- Laybuy: Instant Payment Service

- Afterpay: Interest-Free Installment Payments

- Zip Pay: Flexible Interest-Free Payments

- Clearpay: Global Payment Provider

- Splitit: Credit Card Installment Plan

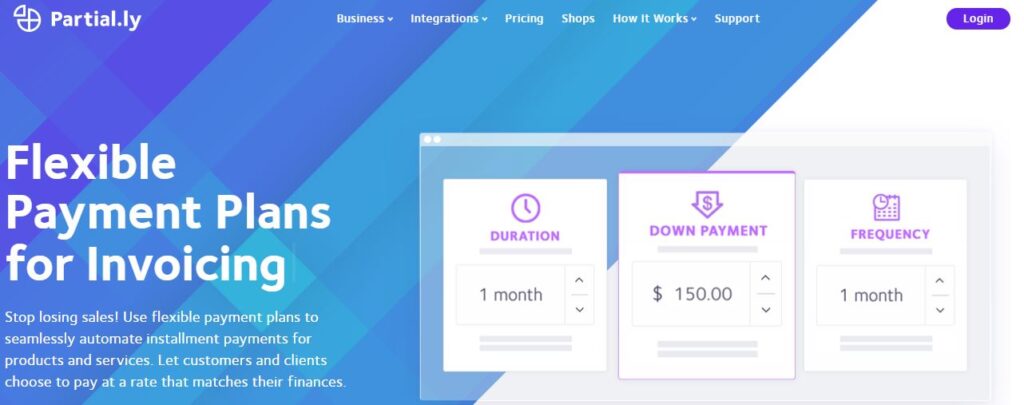

Partial.ly

Partial.ly is a payment solution that helps businesses offer their customers an alternative to traditional payment methods. It allows customers to pay in installments, which can help them manage their cash flow and budgeting better.

With Partial.ly, customers can make payments with no interest or fees over time. Businesses can set up flexible installment plans tailored to the customer’s needs, allowing them to choose between weekly or monthly payments and the number of installments they want to make for each purchase.

By offering Partial.ly as an alternative payment option, businesses can increase sales by making it more convenient for their customers to purchase from them without having all the money upfront. Additionally, Partial.ly offers merchants fraud protection and integration with leading ecommerce platforms like Shopify, WooCommerce, and BigCommerce for easy implementation into their existing store setup.

Partial.ly Site Feature Overview

1: Flexible Payment Plans

2: Automated Payment Reminders

3: Merchant Dashboard Interface

4: Secure Payment Processing

5: Multi-Currency Support

6: Streamline Your Payments

ViaBill

ViaBill is an increasingly popular alternative to traditional payment methods such as credit cards. It allows customers to pay for goods and services in four installments over some time without interest or hidden fees. ViaBill is unique because it can be used online and at physical retail locations.

Unlike Sezzle, which requires businesses to register with their service before they can offer installment payments, ViaBill allows customers to sign up on the spot when making a purchase. It means no additional setup time is required on the merchant’s part, further simplifying their checkout process. In addition, merchants are not responsible for any risk associated with non-payment since ViaBill takes all of this on itself.

Finally, ViaBill’s low transaction fee—just 1%- sets it apart from other installment payment providers. Many different providers charge higher transaction fees than this, making it more attractive for merchants who don’t want to eat into their profits due to too-high processing costs.

About ViaBill features

- Easy Payment Plans

- Automated Accounting

- Real-Time Insights

- Multi-currency Support

- Fraud Protection

PayPal Credit

PayPal Credit is a credit line offered by PayPal as an alternative to traditional forms of payment. It’s available for online purchases, in-store purchases, and cash advances. With PayPal Credit, customers can make payments over time instead of paying the whole amount up front. The credit line offers flexible repayment options such as no-interest financing for six months on select purchases or special promotional financing terms.

Additionally, customers can access their PayPal Credit account through PayPal’s app and manage their card details on the go. Furthermore, users can keep track of all their spending in one place and enjoy fraud protection with every purchase they make with this payment method. Altogether, PayPal Credit provides consumers extra financial flexibility while giving them peace of mind when spending money online or in stores.

PayPal Credit Features

- Benefits: Rewards & Cash Back

- Qualification Criteria

- Fees & Interest Rates

- Applying for PayPal Credit

- Account Management & Security Features

- Easy Financing Option

G2 Deals

G2 Deals is a great alternative for those looking for an easy, convenient way to purchase items online. The website features a variety of products from direct-to-consumer brands like Revolve, Aerie, and Allbirds, as well as big box stores like Walmart and Target. G2 Deals offers competitive prices on everything from apparel and electronics to home goods. With G2 Deals, shoppers can save up to 90% off retail prices while earning rewards points when shopping.

Additionally, members get exclusive access to special promotions and deals that can’t be found elsewhere. On the website, shoppers can easily browse the different product categories or use the search bar for more specific items. Once an item is purchased, it will arrive within 4-7 days, depending on where it’s shipped. Plus, if customers aren’t satisfied with their purchase, they can return it within 30 days for a full refund minus shipping costs.

G2 Deals features

- Design: Easy Navigation

- Functionality: User Friendly

- Price: Affordable Options

- Support: Dedicated Team

- Security: Protects Data

- Shop with Confidence